In fact, a phone survey conducted by Bankrate found that 56% away from People in the us don’t possess sufficient currency saved to fund a $step 1,100000 crisis. Based on CareerBuilder, 78% from Americans real time income to income, meaning that they have little to no offers to pay for unexpected costs. Simply how much you have made, where you secure they, and exactly how your control your money ought to be the earliest something you appear in the when developing debt literacy. When you’re strengthening debt literacy seems like a daunting task, it doesn’t must be. Finance will never be required, but if you choose to pull out money, we would like to make it easier to “borrow wise”.

Get your Credit file

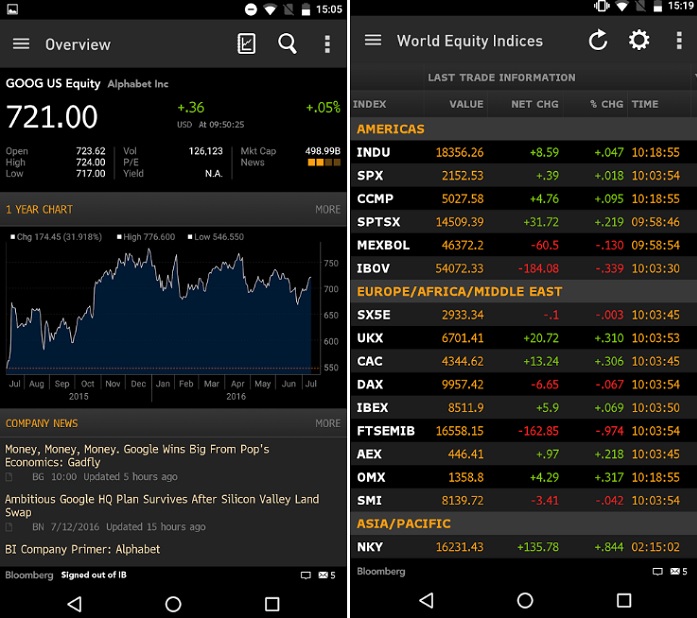

Other investment alternatives, for example stocks, ties and you may mutual money, include additional https://www.washamatter.com/krome-exchange-immediate-evex-pro-alrex-0-7-variace-i700-certified-webpages/ professionals and you will risks. It’s necessary to be aware of the number of exposure you’lso are at ease with and you will harmony one to against your financial desires. So it balance differs from recommendations, therefore knowledge their chance threshold is vital. The fresh flipside is the fact when anyone convey more economic literacy, they do best with saving money, to avoid personal debt, and planning for long-term desires such as old age.

For many who’re still in financial trouble, escape they.

Some other federal nonprofit company in the us, the new National Connection of Investors (NAIC), have concentrated their financial literacy operate specifically to the funding education while the 1951. Inside the 2005, the british Columbia Securities Percentage (BCSC) financed the brand new Eron Home loan Research.[62] It absolutely was the first clinical examination of a single investment scam, targeting over dos,two hundred Eron Home loan buyers. Among other things, the newest report recognized one people handling later years rather than adequate information and you can wealthy center-aged males were prone to financing ripoff.

- You weigh the benefits and you may disadvantages in the fresh short-name and much time-identity position in making economic conclusion.

- Higher-rated ties, called financing-stages ties, try seen as safe and more stable.

- Mastering a few first monetary literacy basics may help you score indeed there.

- They are both economically literate options, according to different people’s needs, knowledge of those individuals things, and you will chance threshold.

You can use your financial allowance to make a plan at the beginning of per month about how exactly you will spend the money you get. You’ll need to look for metropolitan areas to reduce your costs or have the ability to make more money. You’ll need to imagine items such as inflation and you may time horizons — the amount of time kept before your aim. You could potentially falter the goals for the smaller goals and create a schedule to possess success.

Meanwhile, managing minimal financial obligation and you will a cost savings support also have your to your peace of mind and you will security of being economically totally free. Hence, financial literacy isn’t only about recovering having currency to purchase much more blogs—it’s regarding the improving having money to change multiple elements from lifestyle. Getting economically literate is all about acknowledging the brand new feeling of one’s borrowing score on the interest levels, familiarizing your self to the regards to expenses, and carrying out a solution to outlay cash of effectively. Monetary literacy identifies the grasp and you may effective entry to various economic feel, away from budgeting and you may rescuing in order to debt government and you can later years believed. Minimal access to training, lower earnings and you may fewer benefits sign up to the brand new wealth disparity. Better knowledge monetary literacy and ultizing offered resources might help increase individuals’ economic points.

But if you have no idea tips use the effectiveness of these types of preserving vehicle, you may not are able to afford within the later years. This is why its smart to be financially literate and comprehend the various other accounts that might be out there. Banking, budgeting, protecting, credit, debt, and you will paying would be the pillars you to definitely support all monetary choices we’ll generate in life. At the Investopedia, i’ve over thirty six,000 content, terms, Faqs (FAQs), and you can video you to definitely discuss this type of information.

The newest average Annual percentage rate today is almost 25%, but your rate may be highest if you have bad credit. Of many brick-and-mortar banking companies as well as will let you unlock profile and you can manage your money on the web. Financial literacy ‘s the expertise in some aspects of personal finance and the capability to build wise conclusion regarding the currency. Middle-agers consider its holds and shared finance often produce the greatest ten-12 months productivity, but cryptocurrency still exceeded more conventional money automobile for example index finance and you may ETFs. Even though extremely people convey more to learn about electronic currency, one to hasn’t prevented them away from investing in related property, and this means a lot more emerging technology degree is required to see somebody where he could be. Financial literacy is the ability to see the services rules you should manage your currency.

They’re monetary education, capability and you can economic wellness resources. Lowest monetary literacy cost certainly one of girls somewhat impression the life, leading to increased effort, lengthened financial obligation payment minimizing money. In the end, extent you should purchase utilizes your unique finances and you may needs. It’s never too-late to start investing, but the before you begin, the more date disregard the profile needs to grow. If you which each month, you’ll sooner or later fine tune the paying and you may rescuing making it far more in balance and you will effective. To create monetary needs, start by identifying ranging from small-identity and you will a lot of time-identity objectives.

Associated Subject areas

In addition, it raises feel to the subject areas for example over-indebtedness, bank inclusion schemes, a style of payment, bank accounts, credit, discounts and you can insurance policies. Gaining monetary literacy is essential in the now’s community on account of everyday facets of lifetime, including figuratively speaking, mortgage loans, handmade cards, assets, and you will medical insurance. Knowing when you should save or splurge requires lots of punishment, self-handle, and economic training.

With economic literacy, you could potentially habit playing with credit responsibly and taking right out fund just when necessary. You only invest what you can manage to pay back and you will generate money punctually. A clear picture of your current financial situation requires understanding how much money you have got, your own property, plus liabilities.

Having enhanced currency administration knowledge, you can make informed choices about your profit and higher handle your own spending. Enhancing your monetary literacy makes it possible to using your lifetime, out of to make no-brainer choices in order to planning for later years. Thus, it’s very important you have got a substantial comprehension of your finances and you will exactly how your choices feeling your lifetime.

If one makes preserving a consistent habit, also a small amount, you’re building a charity for economic success. As the an authorized Educator inside the Individual Financing (CEPF), the guy authored The new Useful Financial Ratios Publication that is a part of the People to possess Advancing Company Modifying and you will Composing. He’s started quoted within the Business owner, Investopedia, Nasdaq, Forbes, Marketwatch, Team Insider, GOBankingRates, Bing! Finance, and you will Financing Advisor Journal, among others. The guy keeps a diploma running a business and you may Study Analytics out of Biola University.

Tips Dedicate Money

Such as, both of them offer immediate variation and so are professionally handled. However, ETFs try listed on transfers and ETF shares trading from the date just like normal brings. The price of an inventory fluctuates all day and can trust of many items, including the company’s overall performance, the new home-based cost savings, the worldwide economy, a single day’s information, and a lot more.