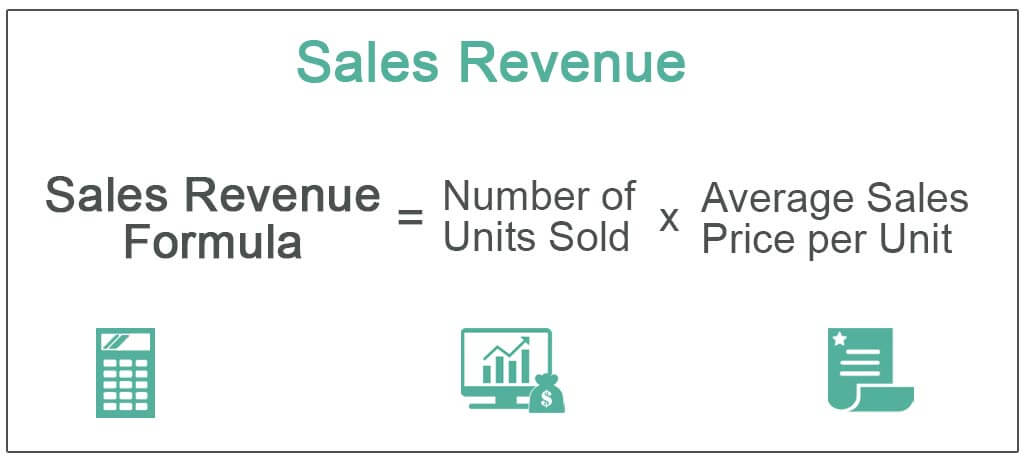

This could be from the sales of products or from various services. It takes into account the number of units sold and the average price of those units. If you’re a service-based business, you calculate sales revenue by multiplying the total number of units sold by how to find revenue in accounting the average sale price. Your sales revenue is generated solely from the total sales of your goods and services. It doesn’t take into account any income generated by other revenue streams. So it’s important to keep in mind that sales revenue only considers sales.

Operating Revenue

This includes any revenue generated from sales, investments or marketing efforts. Sales revenue, on the other hand, only considers revenue generated from actual sales. Operating revenue is revenue your business earns from its main line of business.

Which of these is most important for your financial advisor to have?

These activities are often incidental or peripheral to the primary business operations. Revenue is one of the many metrics investors look at when deciding whether to invest in a company. Growth stocks, for example, would be expected to rapidly grow their sales, whereas defensive income stocks would be expected to report steady revenues.

What Is Accrued and Deferred Revenue?

- For example, when a company releases its financials for each quarter, the financial media reports whether revenue and earnings per share (EPS) are above or below expectations.

- Once you know your entire revenue, you can compare it to your total expenses to see if your business is producing enough money to stay in business.

- There is much more that can be included in a forecast than just the number of units x average price, as you can see in the example above.

- Operating revenue is critical in any business as it is the main source of income for a business.

Below are two examples of business revenue one for products and one for services. Non-profit organisations depend on revenue to continue operating and achieving their objectives. The main sources of revenue for these organisations are donations, grants and investment income.

Your cover letter is a great spot to go into detail about any personal or professional accounting experience. Calculating revenue becomes more difficult if the business is larger or more complex. Some straightforward business models can use the “number of units multiplied by cost per unit” formula to calculate revenue.

For large businesses with higher sales volumes and lower production costs, cost cutting may be an effective strategy. For start-ups and small enterprises, however, lowering pricing is problematic because it can be difficult to raise prices afterwards. Revenue forecasting is a crucial component of business planning. In addition, while deciding whether to provide a business a small business loan; lenders typically need a sales estimate. Based on information from the company as well as from customers and the sector, businesses can forecast their income. In a small business, pricing your products is a challenging problem, but these two total revenue calculations can help you get started.

However, they would not recognize the revenue on their income statement. This would be recognized when the goods or services are delivered to the customer. Looking at a business’s revenue gives you a measure of how effective the company’s sales and marketing efforts are. To get a comprehensive review of the financial health of a company, it’s important to take both cash flow and revenue into account.

Every business, large or small, needs to earn revenue to stay afloat. Operating revenue is especially important for small businesses, as they often have limited resources and tight budgets. Donations can come from individuals, businesses or other organisations, and they can be in the form of cash, property or services. Without accurate financial statements, making informed decisions about where to allocate resources or how to grow the business would be challenging. Understanding revenue and how to calculate it is a core skill for accountants and business professionals. Ultimately, if you have previous work experience or internships in accounting, employers will likely assume you know what revenue is.

Gross revenue, or total revenue, is the sum of all money a business generates from its income sources. Revenue is the money generated from normal business operations, calculated as the average sales price times the number of units sold. It is the top line (or gross income) figure from which costs are subtracted to determine net income. Revenue is the total sales of a business within a reporting period.

In supplementary reports, Microsoft further clarifies revenue sources. For example, if you scroll further down the financial statement you can see how much each division contributed to the $61.9 billion generated in the period. The main component of revenue is the quantity sold multiplied by the price. For a retailer, this is the number of goods sold multiplied by the sales price.

The other sources of income are non-operating transactions—receipt of interest, rent, commission, and royalty fees. The income statement, which is a complete history of how your company performed over a specific time period, can be used to find total revenue. This can be done every month, every three months, or even every year, though we advise checking your financial statements every month.